About Financing

Through different financing options offered by Export Credit Greece (ECG) you can:

Increase your business liquidity

Ensure smoothness and consistency in the conduct of your commercial transactions.

Strengthen your international business activities by ensuring the fulfilment of your contractual obligations to third parties.

Our Solutions

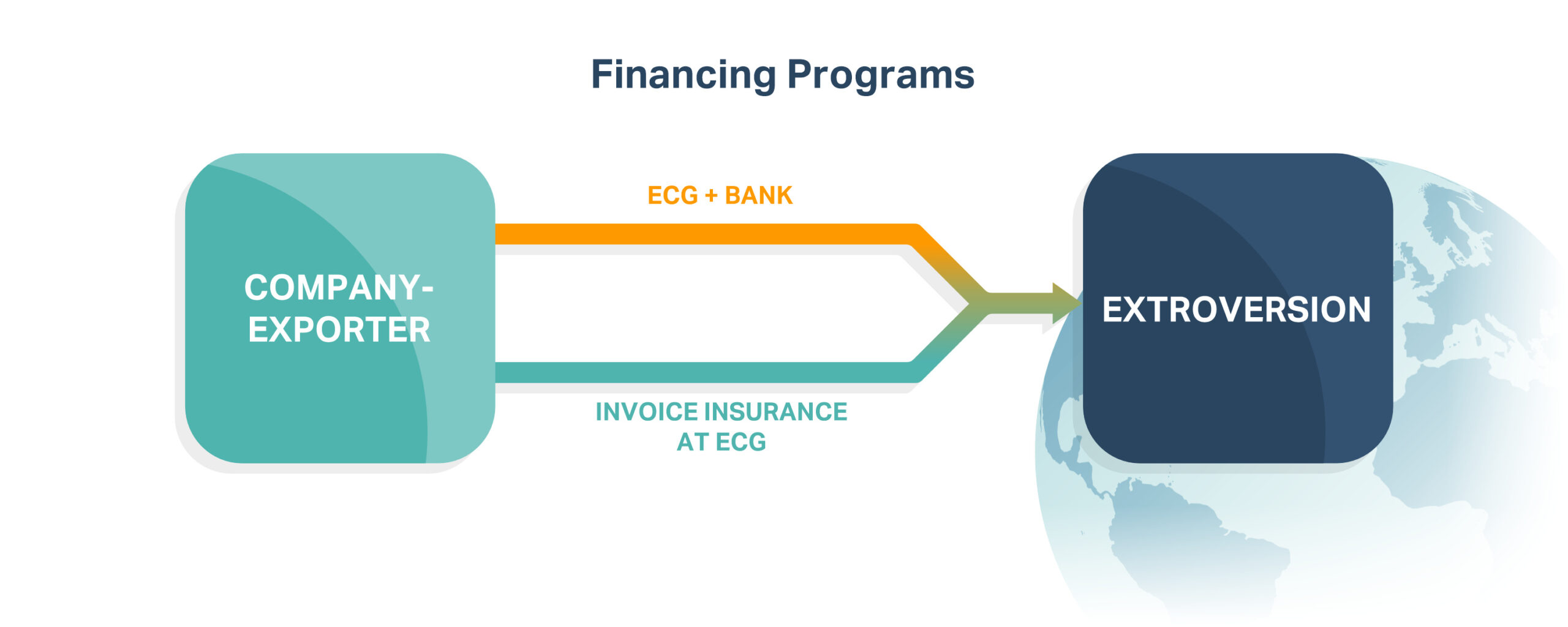

The “Extroversion” program

Export Credit Greece, in close cooperation with the Greek banks, through the “Extroversion” program, strengthens the liquidity of your company by financing your insured invoices. It is essentially a combination of insurance and financing of export credits, which ensures:

- Direct Financing: 80% discount of the value of the invoices you have insured in Export Credit Greece

- Financial Amount: up to € 1,000,000 (revolving)

- Credit of insured invoices: from 1 to 4 months

- Interest rate: Highly competitive

For this program, no collaterals from the bank are required. Export Credit Greece has concluded specific contracts (Framework Contract) with banks and keeps in them frozen funds which are used to finance the program.

Banks participating in the “Extroversion Program”

- Piraeus Bank

- Pancreta Bank

- Εurobank

- Cooperative Bank of Chania

- Alpha Bank

- Cooperative Bank of Central Macedonia

- National Bank of Greece

- Cooperative Bank of Karditsa

- Optima Bank

What is the procedure to be followed?

Step 1

You contact us, we discuss your needs and your potential buyers and you fill out an interest declaration form.

Step 2

Our experienced team assesses the prospective buyers, analyses the risk and proposes all the alternative options.

Step 3

We end up with the financing program that suits you in combination with the insurance program you already have in Export Credit Greece.